Iowa

Iowa GOP tax cut plans raise concerns about long-term impact

DES MOINES, Iowa (AP) — Republicans have released three plans to cut taxes in Iowa and all share the common themes of phasing in a flat personal income tax and eliminating taxes on retirement income at a cost of billions of dollars to state revenue.

Democrats and some progressive groups argue the changes would primarily help high-income residents and risk future budget problems, but Republicans respond that the state is simply taking in too much money and should return it to taxpayers.

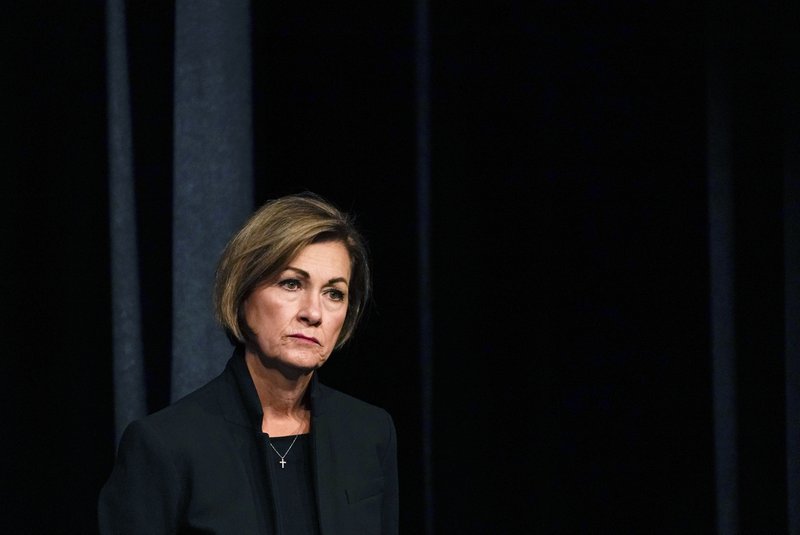

Gov. Kim Reynolds was first to release her plan, which also cuts taxes on corporations. The Senate’s plan also cuts corporate taxes but the House’s proposal does not.

“It’s fair, it’s flat and it’s easy. It makes us more competitive. It helps Iowans keep more of their hard-earned money,” Reynolds said of her plan, which achieves a 4% flat rate tax in four years.

All three plans rely in part on sizable savings the state has amassed as federal dollars poured in to help states compensate for economic loss due the COVID-19 pandemic. Republicans, who control both legislative chambers and the governorship, also credit their management of the budget for nearly $2 billion in unspent funds.

House Democratic Leader Jennifer Konfrst said Republicans want to make political points with their base by giving tax breaks to wealthy Iowans.

“None of that looks at the proposal in a long-term way that actually addresses how we’re going to do this in year five, six or seven rather than just relying on a one-time surplus,” she said.

Iowa House Speaker Pat Grassley defended the proposed tax cuts, pointing to Republican-backed tax reductions in 2018 that he said didn’t damage the state economy as some predicted.

“Very rarely have we discussed tax cuts when we have had over $1 billion in the taxpayer relief fund and you have over $1 billion ending balance. You have cash reserves and rainy day accounts full,” he said.

However, some tax policy analysts predict Iowans will eventually pay the price with program cuts or increases in other taxes, such as property taxes.

“Some future legislature will have to face the music. Those kind of revenue cuts to services Iowans are used to and need are not going to be sustainable,” said Peter Fisher, research director for Common Good Iowa, a nonprofit organization that advocates on a range of social issues including fair taxation, racial equity and the environment.

Reynolds and legislative leaders insist the individual income tax cuts help people with all levels of income. However, it appears that taxpayers earning more than $250,000 a year — about 2% of Iowa taxpayers — will get 35% of the benefits, according to an analysis of Iowa Department of Revenue data by Common Good Iowa. People with an income of less than $50,000 — about 67% of tax filers in Iowa — would get 12% of the benefits, the analysis found,

The Republican tax plans also rely on optimistic projections that Iowa’s annual tax revenue growth won’t drop from levels seen in the last decade. Reynolds’ plan forecasts 4% annual revenue growth and a 2% annual increase in the state budget, which likely isn’t enough to accommodate increased costs due to inflation.

“That outlook is misguided and shortsighted since most state surpluses stem largely from federal COVID relief measures and those dollars are both temporary and are intended to be spent helping families in communities, not funding state tax cuts,” said Wesley Tharp, who studies state policies for the Center on Budget and Policy Priorities, a progressive nonprofit group that focuses on poverty and inequality issues.

Although supporters of tax cuts argue they give a boost to state economies, Tharp said that typically isn’t true. He points to Kansas, which enacted big tax cuts in 2012 and 2013 with a goal of aiding the economy but ended up threatening schools and other vital services are were overturned in 2017 by legislators.

“States should heed Kansas’ example and not repeat the same mistake,” Tharp said.

Supporters of Reynolds’ plan note it leaves the taxpayer relief fund untouched for use if an economic downturn results in lower revenue than projected. Grassley said the House version uses some of the fund to make up for about half of the lost revenue from tax cuts. The rest will come from assumed annual revenue growth.

The Senate GOP proposal gradually lowers tax rates over five years to get to a 3.6% rate in 2027. After that the plan uses the taxpayer relief fund to further lower the tax rates each year, basing the reduction on state revenue and the fund balance, until the individual income tax rate is zero. Currently nine states have no individual income tax. About half of Iowa’s revenue comes from personal income tax.

Iowa is among about a dozen states considering significant income tax cuts this year. Reynolds cites that stiff competition for lower taxes as a reason for pushing more tax cuts now.

“I’m telling you every state across this country is doing exactly what we’re doing in Iowa and if we’re going to remain competitive we have to continue to do it in a responsible way,” she said.