Politics

Wisconsin Lt. Gov. Barnes paid no income tax, was on BadgerCare in 2018

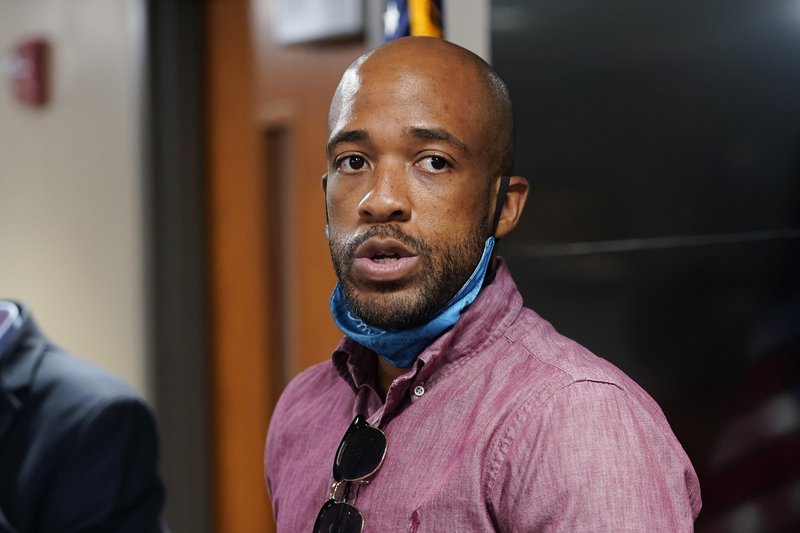

MILWAUKEE (AP) — Lt. Gov. Mandela Barnes paid no income tax in 2018 and was on BadgerCare while he was unemployed and running for lieutenant governor.

He didn’t file a state or federal income tax return that year, according to the Milwaukee Journal Sentinel. Barnes is one of 11 Democrats running for U.S. Senate in 2022 for the seat currently held by Republican Sen. Ron Johnson, who has not said yet whether he will run for a third term.

Barnes’ campaign told the Journal Sentinel that he left his position as a deputy director with State Innovation Exchange in December 2017 and did not have a paid job while running statewide in 2018.

The state says those who made under $11,280 in 2018 did not have to file a Wisconsin return, and the federal figure was $10,400 for single individuals under 65.

Barnes was on the state’s Medicaid program BadgerCare Plus for his health insurance that year, but did not receive food stamps or unemployment compensation, the Journal Sentinel said.

His campaign said Barnes tapped personal savings, including family money from an estate sale, to purchase two condos that year, one in Madison and one in Milwaukee.

“Like millions of Americans, Lt. Gov. Barnes was a non-filer in 2018 as he committed himself to being a full-time candidate and taking his message of equal opportunity to every corner of Wisconsin,” Barnes’ campaign manager Kory Kozloski said.

State Treasurer Sarah Godlewski, also a candidate for Senate, paid no state income taxes for two years. Another Democratic candidate, Alex Lasry, got nearly $24,000 in property tax breaks in New York and Wisconsin that are supposed to be applied only to a primary residence. He is on paid leave from his job as an executive with the Milwaukee Bucks.

“Let me get this straight,” said Irene Lin, campaign manager for Outagamie County Executive Tom Nelson, another Democratic candidate for Senate. “One candidate took an illegal property tax deduction; another didn’t pay any state taxes for two years; and now we learn the lieutenant governor didn’t bother to file income taxes.”